Image

This resource page provides key definitions to help users gain a better understanding of the data and figures presented on this site, as well as relevant documentation on UN inter-agency pooled funds.

It is structured into two sections: overall UN pooled funding concepts and terms used in financial tables and reports.

These terms are based on existing UN definition sources (such as UN financial data standards, UN System Chief Executives Board for Coordination or guidance and knowledge products generated by the UNSDG’s Fiduciary Management Oversight Group).

By understanding these definitions, we expect users can interpret the data and figures on this site and within UN documentation more accurately. We expect this serves you to gain a comprehensive understanding of UN pooled funding and the associated terms.

If you have any additional question on definitions and UN pooled funding, please don't hesitate to contact us at mptfo@undp.org.

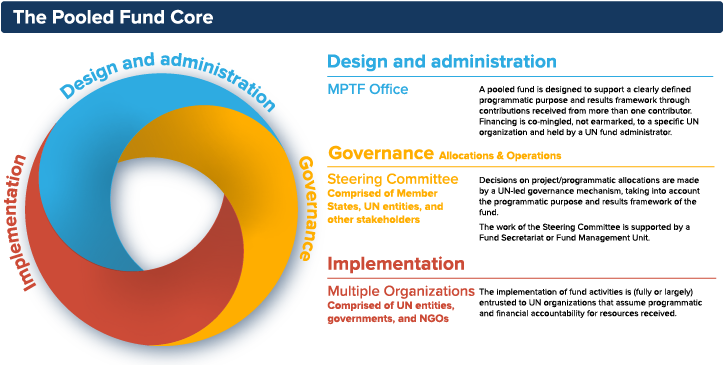

Inter-agency pooled funds are co-mingled contributions to multi-entity funding mechanisms, not earmarked for specific UN entity. Funds are held by a UN fund administrator and allocations are made by a UN-led governance mechanism. Resources are transferred to participating organizations using pass-through modality. The two types of inter-agency pooled funds are multi-partner trust funds and stand-alone joint programmes.

Multi-partner trust fund (MPTF) is the most widely used typology of pooled funds. MPTFs can be global, regional or country-level and are established to support specific national, regional or global development results.

A Stand-alone joint programme (JP) (using pass-through) typically involves two to five UN organizations that have agreed on a specific programmatic scope, budget, and deliverables. Joint programmes can also be financed using parallel and consolidated funding modalities, but these are not considered inter-agency pooled funds.

Pass-through is a fund management modality of inter-agency pooled funds that allows multiple UN organizations to receive contributions from co-mingled donor resources through the Administrative Agent and implement funds using the Participating Organization's operating policies and procedures. It allows partners (contributors and UN entities) to standardize and simplify legal agreements and reduce duplication and administrative overheads.

A Country-level pooled fund (development) is often referred to as SDG country fund; this inter-agency pooled fund is used by a UN country team, under Resident Coordinator leadership, to consolidate and leverage financing towards country priority SDGs as per the UN Sustainable Development Cooperation Framework (UNSDCF).

A Country-based pooled fund (humanitarian) is an instrument that allows donors to pool contributions into single, unearmarked funds to support local humanitarian action. These are administered by the MPTF Office or OCHA and managed by OCHA under the leadership of the Humanitarian Coordinator and in close consultation with the humanitarian community.

Allocation: Amount approved by the Steering Committee for a project/programme.

Approved Project/Programme: A project/programme including budget, etc., that is approved by the Steering Committee for fund allocation purposes.

Commitment: Amount(s) committed by a contributor to a Fund in a signed Standard Administrative Arrangement with the UNDP Multi-Partner Trust Fund Office (MPTF Office), in its capacity as the Administrative Agent. A commitment may be paid or pending payment.

Deposit: Cash deposit received by the MPTF Office for the Fund from a contributor in accordance with a signed Standard Administrative Arrangement.

Delivery Rate: The percentage of funds that have been utilized, calculated by comparing expenditures reported by a Participating Organization against the 'net funded amount'. This does not include expense commitments by Participating Organization. Since expenditures are required to be submitted year-end the delivery rate might actually be much higher than the results presented in Gateway, since the actual annual expenditures are only reported in May of the subsequent year.

Indirect Support Costs: A general cost that cannot be directly related to any particular programme or activity of the Participating Organizations. UNSDG policy establishes a fixed indirect cost rate of 7% of programmable costs for inter-agency pass-through MPTFs.

Net Funded Amount: Amount transferred to a Participating Organization less any refunds transferred back to the MPTF Office by a Participating Organization.

Recipient Organization: A UN Organization or other inter-governmental Organization that is a partner in a Fund, as represented by signing a Memorandum of Understanding (MOU) with the Administrative agent for a particular Fund

Expenditure: The sum of expenses and/or expenditure reported by all Participating Organizations for a Fund irrespective of which basis of accounting each Participating Organization follows for donor reporting. While Participating Organizations are required to submit final year-end expenditures by April 30 in the following year, interim expenditure figures are submitted on a voluntary basis and therefore current year figures are not final until the year-end expenditures have been submitted. Therefore expenditures are not update real-time and therefore users are suggested to use the latest available financial report for certified level of expenditures.

Financial Closure: A project or programme is considered financially closed when all financial obligations of an operationally completed project or programme have been settled, no further financial charges may be incurred and all expenditures have been reported, refunds processed, and certified financial statement has been received.

Operational Closure: A project or programme is considered operationally closed when all programmatic activities for which Participating Organization(s) received funding have been completed, and no further financial charges may be incurred.

Start Date: Project/ Joint programme start date as per the programmatic document. Total Approved Budget This represents the cumulative amount of allocations approved by the Steering Committee.

US Dollar Amount: The financial data in the report is recorded in US Dollars. Receivable entries can also be registered in national currency.

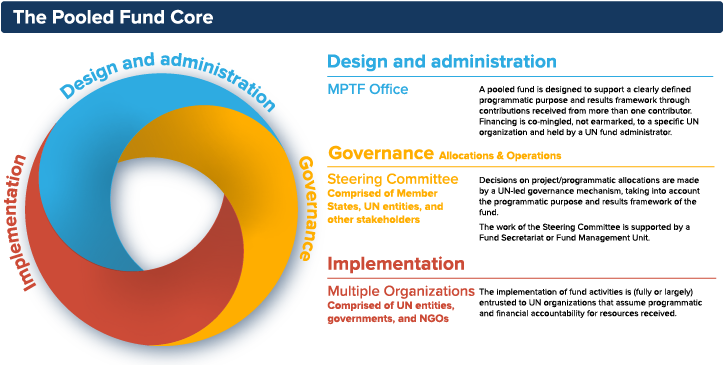

Steps for establishing a pooled fund |

Important documents | |

|---|---|---|

| 1. Convene stakeholder consultations and develop a concept note. Stakeholders (UNCT members, national governments, potential donors, civil society, private sector) agree on added value, potential of the new fund, and map opportunities given existing financing mechanisms. The result is a concept note that outlines programmatic scope and purpose, along with financial and governance arrangements, and a preliminary analysis of financial viability (such as expected donor interest). |

|

|

| 2. Develop and agree on the terms of reference. Using the UNSDG ToR template, the UN Country Team and Resident Coordinator, in consultations with partners (which should include potential contributors), develop and agree on terms of reference narrative based on the concept note and spells out the function, objectives, and governance structure of the fund. Note: It is necessary to select an Administrative Agent (the MPTF Office for country-level pooled funds). |

|

|

| 3. Sign legal documents. Following UNSDG standards, Participating UN Organizations sign a Memorandum of Understanding (MoU) based on the approved terms of reference. Once signed the fund becomes active and legally established, with an option for other Participating Organizations to join at a later stage. |

|

|

| 4. Conclude contribution agreements to capitalize the fund (following Standard Administrative Agreement (SAA) rules) and implement. The Administrative Agent concludes an SAA with donors who wish to contribute to the Fund and private sector contributors that are subject to an additional due diligence process. After the SAA is signed, the fund is operational and the Steering Committee is at liberty to convene and allocate resources. Resource mobilization is a joint endeavor of UN Participating Organizations, partners, and Administrative Agent, with UN Humanitarian Coordinators and Resident Coordinators taking on a leadership role for country-level pooled funds. |

|

Image

Tips for success |

|---|

Build a business case. It is crucial to make a strong case for the fund and communicate added value for the existing SDG financing landscape within a particular country, region, or a particular thematic priority. |

Develop a robust theory of change. Each fund needs to respond to agreed priorities (for example, a global mandate or, for country-level pooled funds, the UN Cooperation Framework). The theory of change must identify how the fund will advance joint work towards priorities, maybe through particular thematic, regional or intersecting areas that galvanize joint action. Funds are not a gap filler. They are a spark for fuelling outcomes and securing additional financing. |

Keep it simple. Avoid the trap of unnecessary management or hierarchies, particularly cascading (double charging) overhead costs or complicated accountability issues that occur in the absence of a UNSDG pass-through modality. |

Design a tailored governance structure. Fund success depends on clear boundaries for roles and responsibilities. In country-level pooled funds, UN Resident Coordinators provide leadership and coordination while UN Participating Organizations and other partners carry out implementation. The MPTF Office provides administration services and act as Administrative Agent. Each fund operates through a dedicated management unit or secretariat. |

Consider the fund as a center of gravity and alignment. Explore the potential to align projects and programmes, and reduce fragmentation caused by multiple/separate funding sources and projects. Sometimes, global funds, like the Peacebuilding Fund or Joint SDG Fund, allow for activities to be financed at the country-level. |

Think “nexus.” Flexible pooled financing is suitable for cross-pillar and humanitarian-development-peace work. |

Limit earmarking. Pooled funds enhance flexible and strategic channels for investments so any earmarking should be at the outcome level (thematic area or cross-cutting issue) and not related to project type. |